Life Insurance in and around Semmes

Get insured for what matters to you

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

Check Out Life Insurance Options With State Farm

When it comes to high-quality life insurance, you have plenty of choices. Evaluating riders, coverage options, providers… it’s a lot, to say the least. But with State Farm, you won’t have to sort it out alone. State Farm Agent Sam Boyce is a person who wants to help you build a policy for your specific situation. You’ll have a hassle-free experience to get economical coverage for all your life insurance needs.

Get insured for what matters to you

Now is the right time to think about life insurance

Love Well With Life Insurance

When it comes to picking how much coverage you need, State Farm can help. Agent Sam Boyce can assist you as you take a look at all the factors that go into the type and amount of insurance you need. These components may include your age, how healthy you are, and sometimes even occupation. By being aware of these elements, your agent can help make sure that you get an appropriate policy for you and your loved ones based on your particular situation and needs.

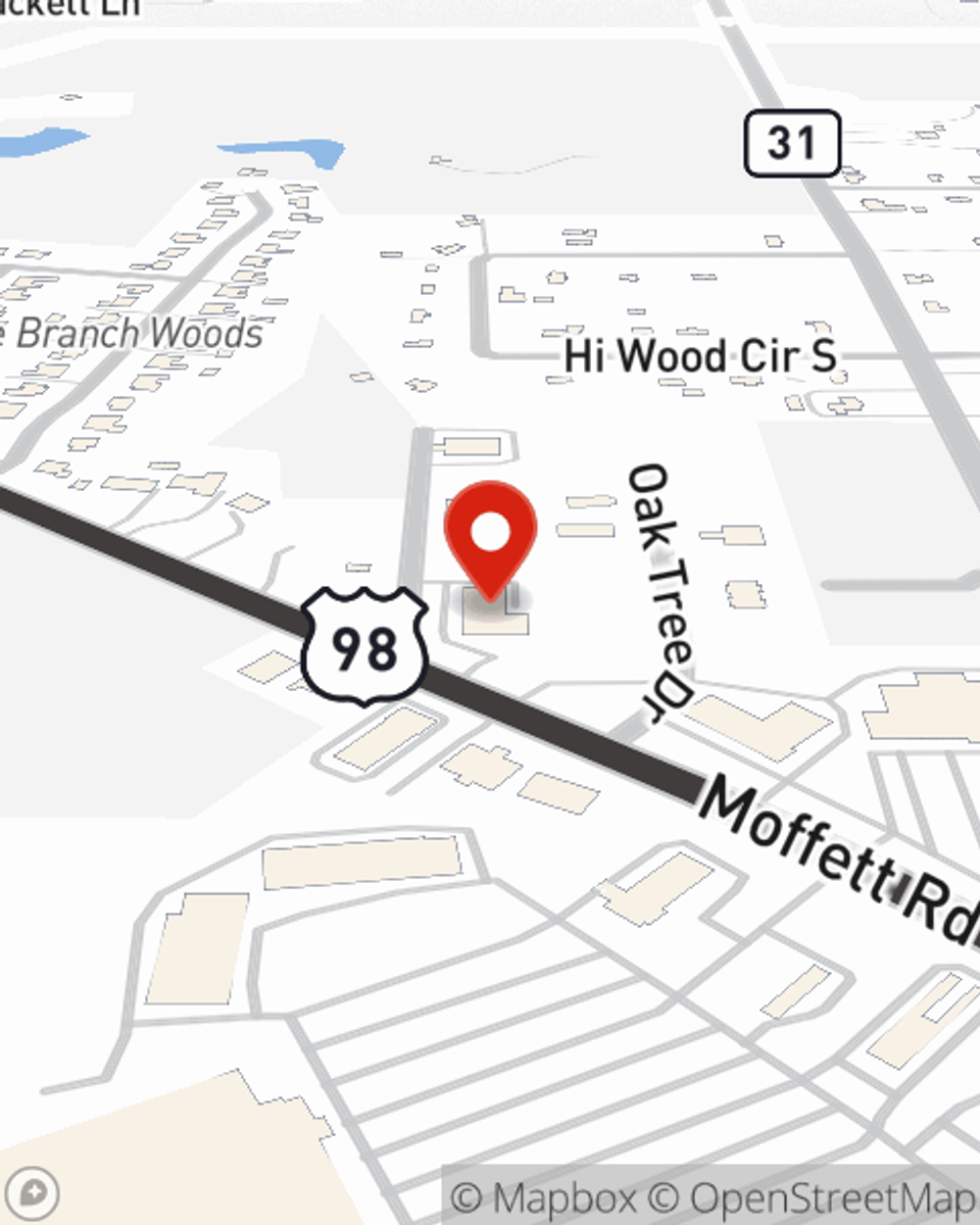

Contact State Farm Agent Sam Boyce today to discover how the leading provider of life insurance can care for those you love most here in Semmes, AL.

Have More Questions About Life Insurance?

Call Sam at (251) 345-6931 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Simple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.